Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes. Why? The Ides of March, more commonly known as March 15, is the federal income tax filing deadline for these “pass-through” entities.

Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes. Why? The Ides of March, more commonly known as March 15, is the federal income tax filing deadline for these “pass-through” entities.

Category: LLCs

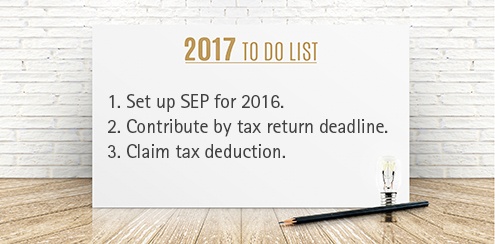

SEPs: A powerful retroactive tax planning tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? Unlike other types of retirement plans, a SEP is easy to establish and a powerful retroactive tax planning tool: The deadline for setting up a SEP is favorable and contribution limits are generous.